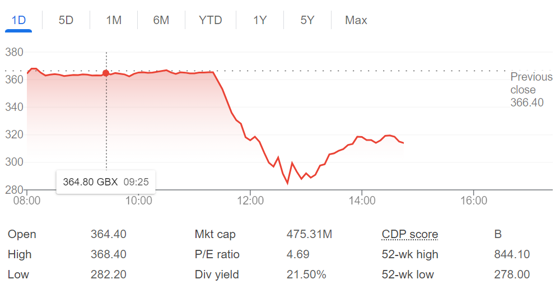

Shares in Close Brothers have taken a sharp hit in the wake of a landmark ruling by the Court of Appeal which determined that motor finance brokers must provide full disclosure on commissions when arranging car loans.

The decision, which also affected shares in Lloyds Banking Group, comes amid a broader investigation by the Financial Conduct Authority (FCA) into potential consumer redress, after it received complaints of overcharging. Other major players in the motor finance market,including Santander also felt the impact of the ruling.

Close Brothers said it plans to appeal to the UK Supreme Court and in the interim will temporarily halt new motor finance lending in the UK as it assesses how its procedures can meet the new compliance requirements.

Close Brothers said it plans to appeal to the UK Supreme Court and in the interim will temporarily halt new motor finance lending in the UK as it assesses how its procedures can meet the new compliance requirements.

The Court of Appeal’s decision has established that brokers have a fiduciary duty to their clients, meaning they are required to act in the customer’s best interest and to avoid conflicts of interest.

This duty prohibits brokers from accepting commissions from lenders without the customer’s “fully informed consent.”

Close Brothers noted that this ruling sets a significantly higher standard for commission disclosure than current FCA regulations.

The FCA has already delayed a response deadline for motor finance companies facing complaints and plans to announce the next steps in its investigation by May.

Analysts suggest that the final compensation figure could exceed £16 billion. Lloyds has already earmarked £450 million to cover its potential liability, with other banks likely to follow suit.

Commenting on the Court of Appeal decision, Stephen Haddrill, director general of the Finance & Leasing Association, said: “This is a significant and unexpected judgment, the implications of which stretch far beyond the motor finance sector, making it an issue that demands the immediate attention of the FCA.”