Used electric vehicle sales increased by 52.6% over Q2, leading an overall increase across all fuel types of 7.2%, according to the latest data from the Society of Motor Manufacturers and Traders (SMMT).

The overall increase represents the sixth consecutive quarter increase for used car sales in the UK and saw an additional 131,128 vehicles sold compared with the same period in 2023.

Transactions have risen in every month of the year, with the first six months up 6.8% to 3,931,318 units – marking the best growth since 2016 and the best first half since 2019.

Year-to-date, the market is now just 3% below pre-pandemic levels.

Used EVs secure highest ever UK market share

Increasing numbers of used car buyers are switching to battery electric vehicles (BEVs), with 46,773 finding new owners between April and June.

It’s the highest ever market share for used EVs at 2.4%, up from 1.7% in the same period last year.

While the overall market is clearly still dominated by more traditional fuel types, it’s an indicator of the direction of travel as used EV sales continue to grow from a small base.

Sales of plug-in hybrids (PHEVs) and hybrids (HEVs) also grew, up 25.2% to 21,580 units and 43.6% to 78,782 units respectively.

Petrol and diesel powered cars still accounted for 92.4% of all vehicles, down from 94.3% last year.

Petrol remained the most popular fuel type, up 9.2%, while diesel fell by 1.2%.

- A used EV masterclass will be held as part of Automotive Management Live on November 13 at the NEC, with award winning automotive retailers sharing their approach. Register now for your free ticket.

Superminis still the most popular used segment

Superminis sustained their position as the best-selling used vehicle type, with volumes increasing by 8.6% to make up 31.9% of transactions, followed by lower medium (27.1% share) and dual purpose (15.8% share).

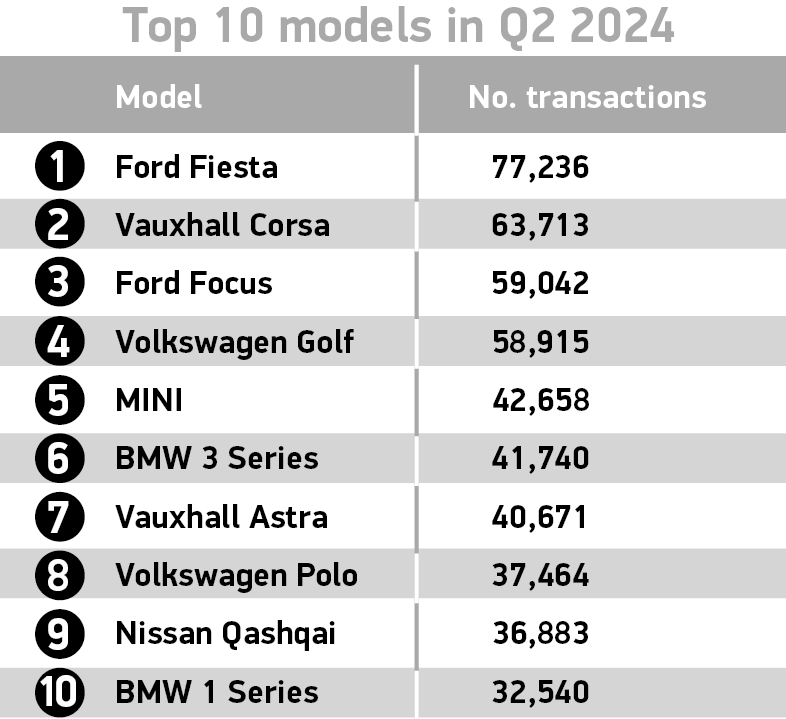

The Ford Fiesta, which has now be discontinued for new car sales, led used car sales in Q2 with 77,236 units sold.

The top three accounted for three quarters of all used vehicles, with only the executive (-4.2%) and luxury saloon segments (-5.4%) recording volume falls.

Black remained the most popular used car colour, recording 6.3% growth and accounting for more than one in five (21.2%) transactions.

Unchanged from last year, grey and blue took second and third places with 17.5% and 16.3% market shares respectively.

White moved into fourth place to push silver back to fifth, while cream/ivory remained at the bottom end of the spectrum, at just 1,194 units.

Mike Hawes, SMMT chief executive, said: “It’s encouraging to see the used car market continue its recovery, with choice and affordability rejuvenated by the new car sector’s sustained run of growth.

“The increased supply of electric vehicles to second and third owners is helping more motorists make the switch – underlining the importance of energising the new EV market to support a fair transition for all.

“Maintaining momentum requires reliable, affordable and green EV charging up and down the country and incentives to get all of Britain on board the net zero transition.”

Middle-aged model bright spot for used EVs

Ian Plummer, Auto Trader commercial director, said: “The maturing electric market’s been a bright spot this year, particularly those ‘middle-aged’ models which have benefitted from a significant softening in price.

“Used EVs are currently selling at their fastest rate in eight months, while those aged 3-5-years-old, which are now broadly at price parity with their petrol counterparts, are the fastest selling segment of the used car market, and by some margin. Clearly, when the price is right, buyers are eager to make the switch.”

Plummer said the overall used market got off to a roaring start in 2024, despite some market challenges. Retail prices have returned to seasonal norms, used cars sold at near record pace and strong consumer demand.

Plummer added: “With such solid market fundamentals, combined with improving economic and political stability, we’ve every expectation the market will continue on its trajectory, and predict overall sales will be up around 5% by the end of the year.”

James Hosking, managing director of AA Cars, said the used car market is showing interesting trends, with petrol and diesel vehicles becoming more expensive, while EV prices are seeing significant decreases.

Hosking said: “The latest AA Cars Used Car Index showed that the average prices of the UK’s most sought-after used petrol and diesel cars increased 3.5% between the first and second quarters of 2024.

“Drivers wanting to reduce their emissions will see the biggest savings, with prices of EVs and hybrids falling 12% in the same period.

“We’re expecting EV sales to reach record levels this year as more and more drivers are convinced to take the plunge thanks to the considerable savings.

“Despite persistently high interest rates impacting the cost of living, the Bank of England’s recent base rate reduction may bolster consumer confidence and further stimulate the used car market.”

Remarkable resilience, despite margin pressure

Philip Nothard, Cox Automotive insight director, described the Q2 results for the UK used car market as encouraging and played out as Cox had forecasted.

He said: “Despite subdued retail demand, margin pressures, and ongoing constraints in prime three-year-old retail stock, the market has shown remarkable resilience, marking its sixth consecutive quarter of growth.

“The surge in BEV sales is particularly promising, reflecting a significant shift in buyer preferences.”

However, Nothard said it was important not to get too “giddy” when looking at the second half of 2024.

He concluded: “Supply will remain a battleground, and the composition of the car parc is shifting faster than consumer preferences.

“While used values may have settled compared to the volatility seen last Q4, this year’s Q4 will likely see renewed turbulence as the rush to meet ZEV mandate targets intensifies in the new car market.”