Vice President Kamala Harris and former President Donald Trump have both made numerous promises, some in the realm of vague pledges and others backed by detailed policies, that carry hefty price tags. But Trump’s proposals would add twice as much red ink to the nation’s debt over the next decade as those advanced by Harris, a new analysis finds.

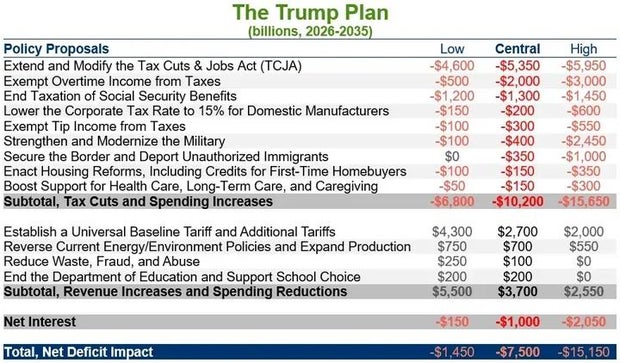

The report from the nonpartisan Committee for a Responsible Federal Budget (CRFB), a nonprofit group that focuses on fiscal issues, projected that the former president’s proposals would increase the national debt by $7.5 trillion through 2035. The vice president’s policies would raise the debt by $3.5 trillion, estimates CRFB, which pushes for lower government deficits.

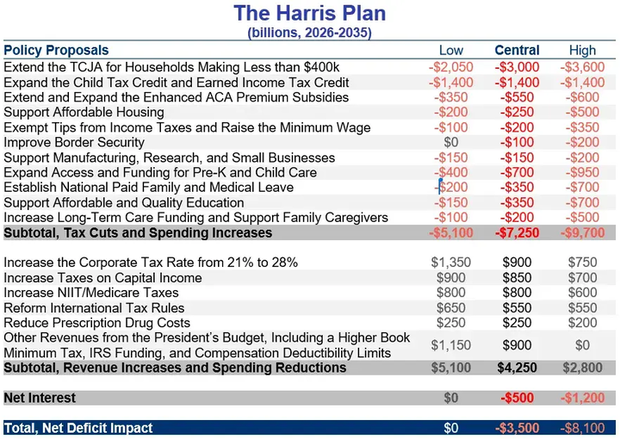

The committee offered a range of estimates in its report due to a lack of specifics in each candidate’s proposals. Depending on those all-important details, Harris’ proposals could range from having essentially no financial impact on the federal debt to raising it by $8.1 trillion, the group estimates. Trump’s plans could expand the debt by between $1.5 trillion on the low side and up to $15.2 trillion, according to CRFB.

“Whoever wins the 2024 presidential election will face an unprecedented fiscal situation upon taking office,” the committee stated in its report. “Both the Republican and Democratic candidates for president have put forward campaign plans that would, at best, maintain the status quo and, at worst, add tremendously to our debt and deficits.”

Committee for a Responsible Federal Budget

Committee for a Responsible Federal Budget

Much of the cost baked into Trump’s proposals comes from his plan to extend tax cuts contained in the 2017 Tax Cuts and Jobs Act, which CRPB estimates would add more than $5 trillion over a decade to the nation’s nearly $36 trillion national debt. His plan to eliminate taxes on overtime, tips and Social Security benefits would cost another $3.6 trillion, CRFB estimated. And conducting mass deportations of undocumented immigrants would increase the debt by another $350 billion, it calculated.

“The CRFB opposed President Trump’s highly successful Tax Cuts and Jobs Act and supported the catastrophic Inflation Reduction Act, which passed only as a result of Kamala Harris’ tie-breaking vote,” Brian Hughes, a Trump campaign senior adviser, told CBS News in a statement. “President Trump’s historic tax cuts laid the foundation for robust, non-inflationary growth that fueled more revenue for the federal government, not less.”

“President Trump’s plan will rein in wasteful spending, defeat inflation, reduce the burden of interest costs and ignite economic growth that fuels federal revenue, so we can make our economy great again,” Hughes added.

A representative from the Harris campaign didn’t immediately offer comment on CRFB’s analysis.

The Republican nominee has argued that tariffs on U.S. imports would cover the tax cuts, but the study findings challenge that claim. Many economists also contend that Trump’s proposed tariffs on goods from China and other trading partners would increase prices for consumers.

“Tariffs are taxes on imported goods, so rather than easing inflation they can worsen it,” according to David Ortega, an economist and a professor at Michigan State University’s College of Agriculture and Natural Resources.

Harris would add $3 trillion to the national debt by extending tax cuts for people earning less than $400,000 a year, and another $1.4 trillion by expanding the Child Tax Credit and Earned Income Tax Credit, according to CRFB. The Democrat’s campaign has said the plans would cost much less.

Harris has also called for an end to income taxes on tips, but the proposal includes keeping payroll tax requirements and restrictions on what type of employees would be eligible, costing $200 billion, CRFB estimated.